Commissioners learned about tax exemptions for medical patients and cooperatives, and the potentially dramatic impact of a statutory change redefining eligible cannabis purchases.

Here are some observations from the Tuesday August 3rd Washington State Citizen Commission for Performance Measurement of Tax Preferences (WA Commission for Measurement of Tax Preferences) Public Meeting.

My top 3 takeaways:

- Tax exemptions for medical cannabis products in RCW 82.08.9998 had been under review by staff of the Washington State Joint Legislative Audit and Review Committee (JLARC).

- Exemptions were established in 2015 via HB 2136 (“Relating to comprehensive marijuana market reforms to ensure a well-regulated and taxed marijuana market in Washington state.”). In 2016, Washington State Department of Revenue officials released a notice on Sales and Use Tax Exemptions for Marijuana Retailers with a Medical Endorsement which stated that the exemption applied to “products determined by the Department of Health (DOH) to be beneficial for medical use to qualifying patients.”

- In November 2020, staff proposed study questions for a review of medical cannabis tax exemptions that was initiated by JLARC in December 2020. The exemptions apply to sales and use tax for medical cannabis patients that registered their authorizations in a state database, medical patient cooperatives, or any adult purchasing low tetrahydrocannabinol (THC) cannabis products.

- Like all cannabis consumers, patients pay a 37% excise tax to the State. Legislation creating a limited exemption for that tax sponsored by Senator Karen Keiser was heard on March 16th and remained active through the 2022 legislative session.

- At the JLARC July 21st meeting, staff provided a review of the preliminary report and a video presentation. The report recommended “The Legislature should continue the preferences because they provide tax relief to medical cannabis patients...The Department of Revenue and the Department of Health should update guidance to reflect 2019 statutory changes.” The preference was associated with an estimated biennial beneficiary savings of $4.9 million but that total could be impacted by a 2019 statutory change allowing the exemption “only to purchases of products that meet” DOH compliant product standards.

- JLARC Research Analyst Scott Hancock presented the preliminary report to the commission and expounded upon what cannabis items were viewed by Washington State Department of Health (DOH) staff as "beneficial for medical use" (audio - 4m, video).

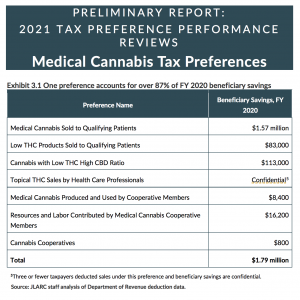

- Hancock said there were seven tax preferences in the report with “no expiration date” and “estimated beneficiary savings for the 2021-2023 biennium are $4.9 million.” Staff found that the preferences “provide tax relief to patients and cooperatives” but “after 2019 statutory changes” due to HB 5298 (“Regarding labeling of marijuana products”) “it is unclear how a pending taxpayer guidance may affect beneficiary savings.”

- The original bill language did not revise the tax exemption. A striking amendment introduced by Keiser on the senate floor on March 11th, 2019 added the change as section 4 of the bill. That section was incorporated into the session law, modifying RCW 82.08.9998(1)(a) as follows (underlined sections indicate additions):

- “(a) Sales of marijuana concentrates, useable marijuana, or marijuana-infused products, identified by the department of health in rules adopted under RCW ((

69.50.375to be beneficial for medical use)) 69.50.375(4) in chapter 246-70 WAC as being a compliant marijuana product, by marijuana retailers with medical marijuana endorsements to qualifying patients or designated providers who have been issued recognition cards.”

- “(a) Sales of marijuana concentrates, useable marijuana, or marijuana-infused products, identified by the department of health in rules adopted under RCW ((

- The term “beneficial for medical use” had been addressed by DOH staff in WAC 246-70-010, which reads: “At this time, the decision of what marijuana products may be beneficial is best made by patients in consultation with their health care practitioners. For this reason, the department will not limit the types of products available to qualifying patients. Instead, the department intends to create standards for products that any consumer can rely upon to be reasonably safe and meet quality assurance measures.”

- The original bill language did not revise the tax exemption. A striking amendment introduced by Keiser on the senate floor on March 11th, 2019 added the change as section 4 of the bill. That section was incorporated into the session law, modifying RCW 82.08.9998(1)(a) as follows (underlined sections indicate additions):

- As medically endorsed cannabis retailers were involved in “six of the seven preferences,” this meant that those exemptions only existed in 32 of Washington’s 39 counties, Hancock observed. Of the 510 licensed retailers, he noted that 275 had medical endorsements, though only 205 had reported exempted sales.

- Hancock reported that in fiscal year (FY) 2020 “more than 87% of beneficiary savings were realized under one of the seven preferences.” That preference was modified in 2019, he told the commission, to apply “specifically to DOH compliant products” although rulemaking had not implemented that distinction, and there’d been no “guidance to taxpayers.” Hancock said that DOH and DOR representatives were addressing that issue but the “effects of those revisions are uncertain.” In FY 2020, “less than 1% of beneficiary savings for this preference were for purchases identified as DOH compliant product,” he remarked, with a savings to patients of “approximately $7,000."

- Hancock said the recommendation of the “legislative auditor” was to continue the preferences as they “achieve the objective of providing tax relief to medical cannabis patients” while DOH and DOR officials “should update guidance to reflect 2019 statutory changes.”

- Hancock said there were seven tax preferences in the report with “no expiration date” and “estimated beneficiary savings for the 2021-2023 biennium are $4.9 million.” Staff found that the preferences “provide tax relief to patients and cooperatives” but “after 2019 statutory changes” due to HB 5298 (“Regarding labeling of marijuana products”) “it is unclear how a pending taxpayer guidance may affect beneficiary savings.”

- Questions on products, cooperatives, and medical utility of the plant were addressed by Hancock before Chair Grant Forsyth invited written comments ahead of a Thursday September 9th commission meeting devoted to hearing public testimony on the tax preferences.

- Vice Chair Ronald Bueing wanted to know what constituted medically compliant cannabis products, specifically “between the products that qualified before and, and now qualify, is it merely a matter of registration...or is it the nature of the products itself?” (audio - 6m, video)

- Hancock responded that prior to 2019 RCW 82.08.9998 referenced cannabis items “beneficial for medical use," with that determination left to DOH leaders. As specified in rule by DOH staff, federal cannabis restrictions resulted in “insufficient evidence to identify which particular characteristics of a marijuana product made it beneficial for medical use.” Instead, the rules “defer to the relationship between patients and their healthcare providers,” assuming that any registered patient retail purchases “were being used for medical use.”

- Passage of SB 5298 removed the term “beneficial for medical use" in favor of referencing “a product quality assurance standard” established by DOH officials, with Hancock assessing that this “narrowed the scope” of the tax exemption. He made clear there had been no updated guidance for the public nor in state rules, with DOH and DOR staff still evaluating if there was “an update that is needed.”

- Bueing found it sounded like the issue wasn’t about “the nature of the uses of the product” but was “more along the lines of...the prior products were not necessarily tested at the higher level.” Hancock agreed, saying that before 2019, DOH staff hadn’t limited products under the preference. Bueing noted that now licensed producers would have to make an effort “to certify, essentially, that the product was compliant.” Hancock demurred, saying it was “to be determined” by officials if changes in rule or guidance were necessary.

- Forsyth inquired about patient cooperatives, with Hancock informing him the groups were limited to four patients or designated providers and couldn’t involve exchange of money among them. Cooperatives have “to be located at the home of, of one of the cooperative members” which was registered with DOH. Forsyth asked if this was “small scale” production, and Hancock confirmed the number of plants allowed in a cooperative was limited (audio - 2m, video).

- Forsyth next asked about establishing “medical benefits” of cannabis products, and if that was not possible due to “continuing federal restriction.” Hancock asserted that this was the determination of DOH staff, as federal cannabis prohibition limited research “that could help them determine particular characteristics of a marijuana or cannabis product...as making it beneficial for medical use.” Forsyth was surprised U.S. officials continued to wait, given how many states had “some form of legalization” for either medical or adult use purposes (“as if we're all gonna go back”). Until federal representatives “catch up with the states,” he suspected regulators in Washington and elsewhere were relegated to “these alternative definitions to judge by" (audio - 2m, video).

- Learn more about efforts to remove cannabis from Schedule I status, including a 2016 analysis from the U.S. Drug Enforcement Administration (DEA) in favor of maintaining the plant’s status and a Congressional Research Service document on the topic from September 2020. A federal appeals court rejected a 2020 petition to reclassify cannabis on August 30th after hearing oral arguments in June.

- On September 2nd, DEA representatives announced Proposed Adjustments to the Aggregate Production Quotas for Schedule I and II Controlled Substances, following efforts by the federal agency to expand cannabis research opportunities months earlier in May.

- Bueing sought regulatory clarification from “the controlled substances side of things,” with Hancock indicating that although Washington State Liquor and Cannabis Board (WSLCB) CFO Jim Morgan was in attendance, the relevant rules were under DOH authority and notices had been issued through DOR (audio - 2m, video).

- Forsyth reminded attendees that the commission would accept written comments on the topics they’d discussed through the contact information provided on their website (audio - 1m, video). He added that the next commission meeting would be on Thursday September 9th and include an agenda devoted to hearing public testimony on the tax preferences (audio - 1m, video).

- See “Proposed Questions for Testifying Parties to Address in 2021” suggested by JLARC staff.

- Vice Chair Ronald Bueing wanted to know what constituted medically compliant cannabis products, specifically “between the products that qualified before and, and now qualify, is it merely a matter of registration...or is it the nature of the products itself?” (audio - 6m, video)

Information Set

-

Announcement - v1 (Jun 24, 2021) [ Info ]

-

Announcement - v2 (Jul 26, 2021) [ Info ]

-

Agenda - v1 (Jul 26, 2021) [ Info ]

-

Tax Preference Review - Medical Cannabis - Preliminary Report (Jul 12, 2021) [ Info ]

-

Tax Preference Review - Medical Cannabis - Summary (Jul 7, 2021) [ Info ]

-

Tax Preference Review - Medical Cannabis - Video (Jul 14, 2021) [ Info ]

-

Complete Audio - TVW

[ InfoSet ]

-

Audio - TVW - 00 - Complete (1h 39m 54s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 01 - Welcome - Grant Forsyth (1m 39s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 02 - Roll Call (51s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 03 - Introduction - Gerry Pollet (3m 26s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 04 - Commissioner Reappointments - Grant Forsyth (46s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 05 - Approval of Minutes (1m 11s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 06 - Guidelines - Keenan Konopaski (2m 47s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 07 - Guidelines - Question - Working From Home - Grant Forsyth (5m 36s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 08 - 2021 Tax Preference Reviews – Preliminary Reports - Eric Thomas (3m 20s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 09 - 2021 Tax Preference Reviews – Preliminary Reports - Comment - Grant Forsyth (1m 33s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 10 - 2021 Tax Preference Reviews – Preliminary Reports - Comment - Ronald Bueing (58s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 11 - 2021 Tax Preference Reviews – Preliminary Reports - Disclosure - Sharon Kioko (45s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 12 - 2021 Tax Preference Review – Preliminary Report - Health Benefit Exchange - Dana Lynn (3m 4s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 14 - 2021 Tax Preference Review – Preliminary Report - Manufacturers' Deferral - Dana Lynn (2m 16s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 16 - 2021 Tax Preference Review – Preliminary Report - Manufacturers' Deferral - Dana Lynn (1m 41s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 22 - 2021 Tax Preference Review – Preliminary Report - Newspapers - Eric Whitaker (5m 59s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 23 - 2021 Tax Preference Review – Preliminary Report - Newspapers - Question - Grant Forsyth (3m 41s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 24 - 2021 Tax Preference Review – Preliminary Report - Medical Cannabis - Scott Hancock (3m 58s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 28 - 2021 Tax Preference Review – Preliminary Report - Dialysis Facilities - Scott Hancock (2m 57s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 32 - 2021 Tax Preference Review – Preliminary Report - Renewable Energy - Rachel Murata (4m 7s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 33 - 2021 Tax Preference Review – Preliminary Report - Renewable Energy - Josh Karas (1m 53s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 34 - 2021 Tax Preference Review – Preliminary Report - Renewable Energy - Eric Whitaker (2m 24s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 37 - 2021 Tax Preference Review – Preliminary Report - Urban Area Exemption - Dana Lynn (4m 1s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 40 - 2021 Tax Preference Reviews – Preliminary Reports - Wrapping Up - Grant Forsyth (1m 4s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 41 - Wrapping Up - Grant Forsyth (48s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 42 - 2021 Tax Preference Reviews – Public Testimony Instructions - Keenan Konopaski (1m 57s; Aug 30, 2021) [ Info ]

-

Audio - TVW - 43 - Wrapping Up - Grant Forsyth (45s; Aug 30, 2021) [ Info ]

-

WA Commission for Measurement of Tax Preferences - General Information

[ InfoSet ]

-

Handout - Proposed Questions for Testifying Parties to Address in 2021 (Apr 26, 2021) [ Info ]