Members learned about specific laws and factors regulators had to consider when changing cannabis retail allotments, evoking several questions and suggestions from participants.

Here are some observations from the Wednesday June 30th Washington State Legislative Task Force on Social Equity in Cannabis Licensing Work Group (WA SECTF - Work Group - Licensing) Public Meeting.

My top 2 takeaways:

- Christy Curwick Hoff, lead staffer for the task force, provided a presentation on statutory requirements for cannabis retail allotments to the work group (audio - 24m, Presentation).

- Work Group Co-Lead Monica Martinez introduced Hoff, stating that her briefing would address “statutory considerations for determining how many licenses should be allocated” and include information on “population growth, safety and security, retail stores per capita, and growth in sales over time.” She explained there would be a question and answer (Q&A) session for work group members afterwards and Washington State Liquor and Cannabis Board (WSLCB) staff were in attendance to “answer some questions, hopefully.” Once work group members had asked questions, the Q&A would be opened up to members of the public in attendance.

- WSLCB Licensing division staff gave a similar presentation to WSLCB board members on May 25th, covering agency policy around retail allotments.

- Hoff began by describing what laws would apply for “the LCB to issue additional licenses...what those requirements would be.” Her presentation laid out three applicable statutes:

- “RCW 69.50.345 – LCB has authority to determine the number of retail outlets licensed in each county (consideration to population distribution)”

- RCW 69.50.345(2) described WSLCB staff authority to determine how many retail outlets could be licensed. Hoff said agency officials needed to consult with the Washington State Office of Financial Management (WA OFM), apportion stores “by county,” and consider:

- “(a) Population distribution;

- (b) Security and safety issues;

- (c) The provision of adequate access to licensed sources of marijuana concentrates, useable marijuana, and marijuana-infused products to discourage purchases from the illegal market; and

- (d) The number of retail outlets holding medical marijuana endorsements necessary to meet the medical needs of qualifying patients.”

- Hoff suggested the work group could weigh these aspects as part of a recommendation to WA SECTF to request more retail allotments. She noted Washington State Department of Health (DOH) Medical Marijuana Program Manager Allyson Clayborn had reported on that program earlier in the meeting so work group members could better consider cannabis patient needs.

- RCW 69.50.345(2) described WSLCB staff authority to determine how many retail outlets could be licensed. Hoff said agency officials needed to consult with the Washington State Office of Financial Management (WA OFM), apportion stores “by county,” and consider:

- “RCW 69.50.335 – LCB has authority to open retail license applications for social equity applicants (unused, current allotments)”

- Hoff reiterated that “the current number is 38” available licenses but she anticipated “that will change” as more retail licenses qualified as “unused.”

- A list of available allotments from September 2020 and a licensing presentation provide more details on the retail allotments and their locations.

- Hoff reiterated that “the current number is 38” available licenses but she anticipated “that will change” as more retail licenses qualified as “unused.”

- “RCW 69.50.336 – Any recommendation of the SECTF to increase the number of retail outlets must be approved by the legislature.”

- Hoff acknowledged that the “co-leads and several of our members have explicitly stated in this meeting” that they believed additional retail licenses were warranted. She shared that staff assessment of the laws was that “Legislative action is required to increase retail license allotments specifically for the social equity program.” Although WSLCB leaders possessed “the authority to issue additional licenses, it wouldn’t be able to do that and set them aside for the social equity program,” she argued. Any new licenses would be “available, sort of, generally” and not specifically for prospective social equity applicants.

- “RCW 69.50.345 – LCB has authority to determine the number of retail outlets licensed in each county (consideration to population distribution)”

- Hoff then spoke to “some data that I pulled together which I think could shed some light on....what does the industry look like right now...can it support more retail licenses” and “if so, how many?” She asked the work group to consider “what are the other metrics and data points that you would want to know” beyond the subjects she identified.

- Hoff indicated that WA OFM demographic estimates indicated that Washington’s population grew 11% from 2013---when retail allotments were first introduced---to 2020, from 6,882,400 people to 7,656,200. She clarified that she did not have population estimates for Washingtonians aged 21 years and older, the legal age to buy and possess cannabis in the state.

- For “security and safety,” Hoff identified two research articles on the subject, noting there was likely “a lot more that could be pulled together.” She found that those both for and against legalization of cannabis had pointed to public safety as a bellwether issue that would validate their position. Hoff invited other data sources on the topic to be shared in the meeting chat box.

- The Washington State Institute for Public Policy (WSIPP) issued many reports on the impacts of cannabis legalization in Washington. A few directly evaluated criminal activity, including an August 2019 report titled Suppressing Illicit Cannabis Markets After State Marijuana Legalization as well as evaluations of youth cannabis use. Other research on the topic includes:

- Effects of Marijuana Legalization on Law Enforcement and Crime: Final Report (National Institute of Justice: June 2020)

- The Cannabis Effect on Crime: Time-Series Analysis of Crime in Colorado and Washington State (Washington State University [WSU]: October 2019)

- Marijuana Legalization and Crime Clearance Rates: Testing Proponent Assertions in Colorado and Washington State (WSU: July 2018)

- Marijuana Legalization in Washington State: Monitoring the Impact on Racial Disparities in Criminal Justice (University of Washington Alcohol and Drug Abuse Institute: June 2018)

- The Washington State Institute for Public Policy (WSIPP) issued many reports on the impacts of cannabis legalization in Washington. A few directly evaluated criminal activity, including an August 2019 report titled Suppressing Illicit Cannabis Markets After State Marijuana Legalization as well as evaluations of youth cannabis use. Other research on the topic includes:

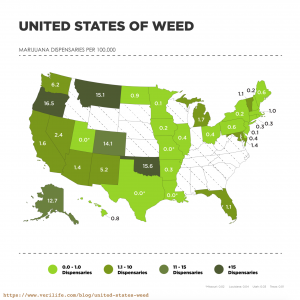

- Hoff turned to the number of cannabis stores per 100,000 residents, offering a per capita comparison between Washington state and other states having dispensaries and retail cannabis. According to her information, Washington had the 5th highest number of stores per capita at 6.2 per 100,000, behind Oregon, Montana, Colorado, and Alaska. Hoff noted that Washington, Colorado, Oregon, Alaska, and Washington, D.C. were “a little bit more comparable in terms of having a mature industry.”

- At publication time, Washington, D.C. did not allow sales of adult-use cannabis.

- Next, Hoff went over state revenue from cannabis sales for the past several fiscal years (FY), observing that she’d encountered “slightly different numbers depending on the different, sort of, sources.” She said the amounts in the presentation were taken from the 2020 annual report by WSLCB staff.

- She provided data that the cannabis sector contributed 18,700 full time equivalent jobs to the state economy and generated $468.81 million in state tax revenues from direct retail sales in 2020. Hoff asserted that the “pretty dramatic increase” in sales could indicate that “the market could support additional stores” and that more stores could lead to more jobs and revenue, as cannabis revenue already exceeded taxes generated by either alcohol or tobacco products. She also noted a news article on how cannabis dollars were spent in the prior fiscal biennium.

- Other cannabis revenue spreadsheets were available on the frequently requested lists page for WSLCB.

- Monthly cannabis revenue in Washington was tracked by OpenTHC as well as 502 Data.

- Find out where cannabis tax dollars were appropriated in the FY 2021-23 biennium operating budget.

- Hoff noted that limited demographic data available for current retail licensees from WSLCB staff indicated that, of active licenses, 82% self-identified as “White.” She added that Washington state’s population was “67% White, and yet our retail licensees are 82% White, so we definitely have a disparity there.”

- Seven percent of retailers self-identified as Asian American, with nine percent of the state’s population being part of that community.

- Three percent self-identified as Black or African American while four percent of the state’s population were from that community.

- Only two percent of retailers were Hispanic/Latina/Latino, while 13% of the population were from that community.

- Four percent of retail owners self-identified as multiracial and another two percent as “other,” with a breakdown of the latter group provided. Hoff indicated that “Native Hawaiian/Pacific Islanders and American Indian/Alaskan Natives both make up one percent of the population.”

- Considering “equity,” Hoff noted that “cannabis convictions and arrests have not been felt equally across our populations,” citing data provided at the first WA SECTF meeting in October 2020. Her presentation included statistics showing disparities in the arrest rates for cannabis possession among communities of color in Washington in the years before passage of Initiative 502, which she noted hadn’t included equity provisions. She posited that retail ownership could counterbalance the negative impact of disparate enforcement from “the war on drugs” as work group members prepared to offer “long-term goals” for equity in cannabis licensing to the task force.

- In 2019, WSU researchers shared a presentation on post I-502 cannabis arrests in Washington, finding a 14% decrease in the disproportionality of African Americans arrested for cannabis possession between 2009 and 2015. However, the same data revealed a 127% increase in the proportion of African Americans arrested for cannabis sales.

- Work Group Co-Lead Monica Martinez introduced Hoff, stating that her briefing would address “statutory considerations for determining how many licenses should be allocated” and include information on “population growth, safety and security, retail stores per capita, and growth in sales over time.” She explained there would be a question and answer (Q&A) session for work group members afterwards and Washington State Liquor and Cannabis Board (WSLCB) staff were in attendance to “answer some questions, hopefully.” Once work group members had asked questions, the Q&A would be opened up to members of the public in attendance.

- Work group members and public participants had several inquiries and remarks about retail license allotments, suggesting increased licensure, tax changes, and ways to incentivize local controllers.

- Micah Sherman, work group member and Raven Co-Owner, was curious about the comparison between alcohol and cannabis tax revenue, noting that the “concentration of access points” in cannabis retail was vastly different from the “around 18,000” diverse venues where alcohol was sold in Washington. He said there was a different scale of “market power” between the products and “when we’re talking about equity, that’s about power, and that’s about relative power, and how it’s distributed.” Sherman found that because the “path to market is funnelled through a very narrow moment, the retail store,” cannabis “concentrated” power in that tier (audio - 6m).

- Hoff said it would be “significant work” for WSLCB staff to break the 18,000 licensees into the various license privileges such as on site consumption, but they could do so if the work group requested it. Sherman and Hoff agreed that his point was made without “a parsing of the data.”

- WSLCB doesn’t publish a unified list of alcohol sellers, but does maintain licensee lists for on-premises consumption and off-premises consumption.

- Paul Brice, Happy Trees Owner and WA SECTF Advisory Member, wondered if there was an increase in liquor sales once that industry was privatized in 2011 and the number of licensed spirits retailers increased dramatically.

- Martinez mentioned the relative tax rates imposed on alcohol and cannabis, asking if any increase in spirits sales after privatization could be evaluated with sales data. WSLCB Chief Financial Officer (CFO) Jim Morgan assured members agency staff could check on any change in sales and get information to the work group.

- For alcohol, taxes are assessed using a per gallon excise tax rate based on product type, whereas cannabis has as 37% excise tax on the value of the product. Using data from the Tax Policy Center, a standard drink of beer in Washington (12 fluid ounces) is assessed a tax of $0.024375 and a standard drink of wine (5 fluid ounces) carries a $0.033984375 tax. A June 2020 comparison from the Tax Foundation showed Washington cannabis was the most taxed among legal states. Learn more about the results of liquor privatization from research by the Washington Policy Center and a 2015 report by the Forecasting and Research Division of the WA OFM.

- Hoff said it would be “significant work” for WSLCB staff to break the 18,000 licensees into the various license privileges such as on site consumption, but they could do so if the work group requested it. Sherman and Hoff agreed that his point was made without “a parsing of the data.”

- Sherman then sought to confirm his understanding that the initial number of cannabis retail stores allotted was decided by WSLCB officials based on the quantity of state-owned liquor stores before privatization. Hoff relayed her understanding that this was the "primary way" the number was determined, and WSLCB Director of Legislative Relations Chris Thompson confirmed in the chat log. Pablo Gonzalez, WA SECTF appointee, suggested there had been other distinctions like hours of liquor sales and “other policy changes.” Sherman felt the number was functionally “arbitrary” (audio - 2m).

- Sheley Anderson, Craft Cannabis Coalition (CCC) Policy Advisor and Washington State Legislative Task Force on Social Equity in Cannabis Technical Assistance and Mentorship Work Group (WA SECTF - Work Group - TA and Mentorship) member, wondered about the excise tax appropriation and if the task force was “able to make recommendations on how that tax revenue is allocated, specifically with a focus to social equity licensees and” disproportionately impacted communities. She wanted to see tax “re-allocating more with a social equity lens.” Hoff said there were specific issues the task force had to make recommendations on, but she interpreted an opportunity for “broader recommendations to the legislature” in the task force’s mandate to advise on a “more equitable cannabis industry.” She mentioned that the TA and Mentorship work group might consider also making a recommendation on the issue to the wider task force, adding that there had already been a presentation reviewing equity investments in other jurisdictions. Hoff said she had “hope” the call for more cannabis equity spending would be endorsed by WA SECTF (audio - 2m).

- Brice asked about local control, wanting to know the “the ability of the cities to stop the allotments,” as it had impacted his path to cannabis licensure before. He argued that WSLCB leaders had “pretty much doubled” allotted stores in counties during a medical retail application window in 2016, including counties hostile to cannabis retail operations. Saying there was sure to be a mix of jurisdictions which wanted more stores and those that didn’t, Brice called attention to a resolution from the City Council in Tacoma in July 2020 calling for more retail shops for social equity purposes and wondered if there was anything that could be done to stop other jurisdictions from opposing new equity licensees (audio - 10m).

- Martinez remarked that “we do not need to move forward with the current system that exists with our recommendations” and that the task force could advise that new equity businesses be “roamable." She presaged that the August 25th work group meeting would “be tackling bans and moratoria” and one idea was for an allotment increase only in areas without bans and moratoriums.

- Hoff said Washington was a “local controlled state” which meant that municipal authorities were allowed to ban cannabis retail directly “or they can use their zoning laws in order to make different restrictions.”

- WSLCB Board Member Ollie Garrett, the agency appointee to WA SECTF, stated that licensing staff had been “reaching out to all of those areas” and “trying to educate them on cannabis” to learn their concerns in hopes local officials might “reconsider” their opposition.

- WSLCB staff provided the task force with a briefing covering bans and moratoriums on January 25th. Martinez discussed the practice during a work group update on July 27th.

- Sherman encouraged participants to get “innovative” in making their case. While working “to establish craft cannabis” via legislation, he’d evaluated “adding something that allocates a portion of the excise tax to the municipality where the transaction occurs” to encourage more participation. He believed local leaders lacked an economic argument to end a ban or moratorium in places where cannabis businesses weren’t popular. Sherman also suggested lawmakers could reduce cannabis taxes at equity cannabis businesses to help their competitiveness against established retailers. Martinez commented that she believed the Disproportionately Impacted Communities Work Group (WA SECTF - Work Group - Disproportionately Impacted Communities) was “tackling” the possibility of recommending the task force ask legislators for tax changes, though Hoff was uncertain.

- Mike Asai, former dispensary owner and work group member, inquired about a tax exemption from the business and occupational (B&O) tax for medical cannabis collectives “from June 30th of 2015 to July 1st of 2016” that was included in SB 5052 in 2015, a law which merged Washington’s unlicensed medical and licensed recreational markets. He reasoned that if “it has been done before” it “should be done” to assist cannabis equity applicants (audio - 4m).

- Micah Sherman, work group member and Raven Co-Owner, was curious about the comparison between alcohol and cannabis tax revenue, noting that the “concentration of access points” in cannabis retail was vastly different from the “around 18,000” diverse venues where alcohol was sold in Washington. He said there was a different scale of “market power” between the products and “when we’re talking about equity, that’s about power, and that’s about relative power, and how it’s distributed.” Sherman found that because the “path to market is funnelled through a very narrow moment, the retail store,” cannabis “concentrated” power in that tier (audio - 6m).

Information Set

-

Agenda - v1 (Jun 23, 2021) [ Info ]

-

Minutes - v1 (Aug 19, 2021) [ Info ]

-

Presentation - State of the Industry - Retail - v2 (Jul 6, 2021) [ Info ]

-

Complete Audio - Cannabis Observer

[ InfoSet ]

-

Audio - Cannabis Observer - 00 - Complete (2h 59m 27s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 01 - Welcome - Michelle Merriweather (2m 16s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 02 - Guidelines - Christy Curwick Hoff (5m 27s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 03 - Introductions (50s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 04 - Introduction - Monica Martinez (28s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 05 - Introduction - Michelle Merriweather (35s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 06 - Introduction - Pablo Gonzalez (2m 39s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 07 - Introduction - Ollie Garrett (21s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 08 - Introduction - Craig Bill (15s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 09 - Introduction - Micah Sherman (1m 21s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 10 - Introduction - Angel Swanson (15s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 11 - Introduction - Mike Asai (57s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 12 - Introduction - Kevin Oliver (41s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 13 - Introduction - Crystal Oliver (20s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 14 - State of the Industry - Producers and Processors - Micah Sherman (15m 33s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 17 - State of the Industry - Producers and Processors - Comment - Mike Asai (2m 14s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 18 - State of the Industry - Producers and Processors - Comment - Jim Buchanan (2m 30s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 20 - State of the Industry - Producers and Processors - Question - Mike Asai (1m 37s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 21 - State of the Industry - Retail - Tamara Berkley (7m 18s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 22 - State of the Industry - Retail - Comment - Jim Buchanan (4m 55s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 23 - State of the Industry - Retail - Question - Natural Blessings - Mike Asai (2m 13s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 24 - State of the Industry - Medical - Allyson Clayborn (9m 52s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 29 - State of the Industry - Medical - Comment - Paul Jackson (42s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 32 - State of the Industry - Medical - Comment - Micah Sherman (4m 23s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 33 - State of the Industry - Retail Allotment - Christy Curwick Hoff (23m 38s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 39 - State of the Industry - Discussion - Michelle Merriweather (1m 41s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 42 - State of the Industry - Discussion - Retail Recommendation - Pablo Gonzalez (2m 25s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 43 - State of the Industry - Discussion - Retail Recommendation - Ollie Garrett (1m 26s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 44 - State of the Industry - Discussion - Retail Recommendation - Micah Sherman (1m 46s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 45 - State of the Industry - Discussion - Retail Recommendation - Mike Asai (4m 11s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 46 - State of the Industry - Discussion - Retail Recommendation - Kevin Oliver (4m 14s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 50 - State of the Industry - Discussion - Increase Amount - Pablo Gonzalez (1m 9s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 51 - State of the Industry - Discussion - Increase Amount - Ollie Garrett (2m 4s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 52 - State of the Industry - Discussion - Increase Amount - Micah Sherman (2m 1s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 53 - State of the Industry - Discussion - Increase Amount - Mike Asai (1m 39s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 54 - State of the Industry - Discussion - Increase Amount - Kevin Oliver (1m 48s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 55 - State of the Industry - Discussion - Comment - Estevan Garrido (5m 41s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 56 - State of the Industry - Discussion - Comment - Jim Buchanan (2m 7s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 59 - State of the Industry - Discussion - Comment - Paul Brice (2m 6s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 60 - Next Steps - Christy Curwick Hoff (1m 55s; Jun 30, 2021) [ Info ]

-

Audio - Cannabis Observer - 61 - Wrapping Up (43s; Jun 30, 2021) [ Info ]

-

-

WA SECTF - Work Group - Licensing - Public Meeting - General Information

[ InfoSet ]

-

Presentation - Work Group Scope and Responsibilities (Apr 20, 2021) [ Info ]

-

WA SECTF - Public Meeting - General Information

[ InfoSet ]

-

Bylaws - v1 (Feb 4, 2021) [ Info ]

-

Operating Principles (Feb 4, 2021) [ Info ]

-

Conversation Norms - v2 (Feb 16, 2022) [ Info ]

-

Recommendations - 2021 (Jan 18, 2022) [ Info ]

-

Recommendations - 2021 - Response - WSLCB (Jan 14, 2022) [ Info ]

-

Legislative Report - v1 (Oct 24, 2022) [ Info ]

-

Legislative Report - v2 (Dec 6, 2022) [ Info ]

-

Legislative Report - v3 (Dec 8, 2022) [ Info ]

-

Legislative Report - Statement - WSLCB - v1 (Nov 17, 2022) [ Info ]

-

-