Six of seven clearly active cannabis bills were on the Governor’s desk awaiting signature into law, veto, or partial veto while representatives tried to offer tax relief to “eligible farmers.”

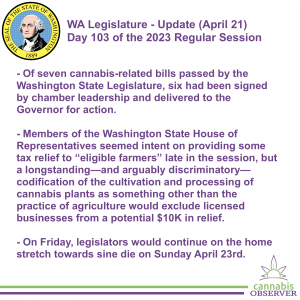

Here are some observations of the Washington State Legislature (WA Legislature) for Friday April 21st, the 103rd day of the 2023 Regular Session.

My top 3 takeaways:

- Of seven cannabis-related bills passed by the Washington State Legislature (WA Legislature), six had been signed by chamber leadership and delivered to the Washington State Office of the Governor (WA Governor) for action.

- At publication time, six cannabis-related bills were on the Governor’s desk:

- HB 1066 - “Making technical corrections and removing obsolete language from the Revised Code of Washington pursuant to RCW 1.08.025.”

- HB 1563 - “Concerning arrest protections for the medical use of cannabis.”

- HB 1772 - “Prohibiting products that combine alcohol and tetrahydrocannabinol.”

- SB 5069 - “Allowing interstate cannabis agreements.”

- SB 5080 - “Expanding and improving the social equity in cannabis program.”

- SB 5367 - “Concerning the regulation of products containing THC.”

- One cannabis bill remained within the Legislature gathering signatures of the President of the Senate and the Speaker of the House:

- SB 5123 - “Concerning the employment of individuals who lawfully consume cannabis.”

- The Executive exercises a check on the power of the Legislative branch when the Governor signs the bill into law or vetoes all or part of the legislation. If the Governor fails to act on the bill, it may become law without a signature. Bills passed more than five days before adjournment of a session must be acted upon within five days. Bills passed within five days of sine die can be acted upon within 20 days.

- See the WA Governor Bill Action screen for notification of bill action ceremonies on the day of the event.

- At publication time, six cannabis-related bills were on the Governor’s desk:

- Members of the Washington State House of Representatives (WA House) seemed intent on providing some tax relief to “eligible farmers” late in the session, but a longstanding—and arguably discriminatory—codification of the cultivation and processing of cannabis plants as something other than the practice of agriculture would exclude licensed businesses from a potential $10K in relief.

- On April 19th, House leadership designated HB 1757 (“Providing a sales and use tax remittance to qualified farmers”) as “necessary to implement budgets” (NTIB) and pulled the bill out of the Washington State House Rules Committee (WA House RUL).

- The bill report on the legislation as passed by the Washington State House Finance Committee (WA House FIN) on March 9th summarized the legislation enabling “An eligible farmer” to “claim a sales and use tax exemption on goods and services purchased. The exemption is in the form of a remittance and the eligible farmer must pay all applicable sales and use taxes on items that are considered goods and services. The amount of the exemption is equal to the amount of B&O taxes paid on custom farming activities between December 31, 2020, and July 1, 2022.”

- While cannabis producers and processors would likely support legislation that promised a potential $10K check from the State government on qualifying historical purchases, they do not fit the definition of “eligible farmer” in RCW 82.08.855 because they are specifically excluded from the more fundamental definition of “farmer” in RCW 82.04.213:

- (1) "Agricultural product" means any product of plant cultivation or animal husbandry including, but not limited to: A product of horticulture, grain cultivation, vermiculture, viticulture, or aquaculture as defined in RCW 15.85.020…"Agricultural product" does not include cannabis, useable cannabis, or cannabis-infused products…

- (3)(a) "Farmer" means any person engaged in the business of growing, raising, or producing, upon the person's own lands or upon the lands in which the person has a present right of possession, any agricultural product to be sold…

- (4) The terms "agriculture," "farming," "horticulture," "horticultural," and "horticultural product" may not be construed to include or relate to cannabis, useable cannabis, or cannabis-infused products unless the applicable term is explicitly defined to include cannabis, useable cannabis, or cannabis-infused products.

- See the Washington State Department of Revenue (WA DOR) special notice on the "Repeal and Clarification of Excise Tax Deductions, Exemptions, and Preferential Rates" for cannabis businesses published in June 2014.

- On April 20th, the House amended and passed HB 1757 nearly unanimously for potential last minute consideration in the Senate.

- On Friday, legislators would continue on the home stretch towards sine die on Sunday April 23rd.

- The Washington State Senate planned to convene at 10am PT on Friday.

- All cannabis bills available to senators for concurrence with House changes had been passed by the body.

- The Washington State House planned to convene on 10am PT on Friday.

- All cannabis bills available to representatives for concurrence with Senate changes had been passed by the body.

- The conference committee on SB 5187, the biennium operating budget, continued its work after members were appointed by the Senate and the House.

- Committee members were scheduled to sign the conference report on Saturday April 22nd at 12pm coincident with the publication of the revised bill text.

- Legislation can be declared "necessary to implement budgets" (NTIB), an informal procedure leadership can exercise around any bill with a fiscal impact. The criteria for NTIB status and the decision making around the designation hadn’t been set in law or rule, allowing for a bypass of the cutoff calendar which is agreed to by both chambers through the legislative process.

- Sunday April 23rd would occasion sine die, the end of the regular session, described as the “Last day allowed for regular session under state constitution.”

- The Washington State Senate planned to convene at 10am PT on Friday.