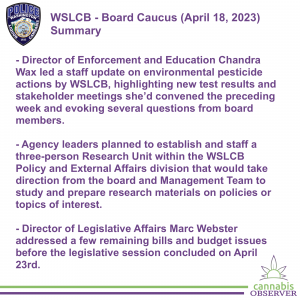

WSLCB - Board Caucus

(April 18, 2023) - Summary

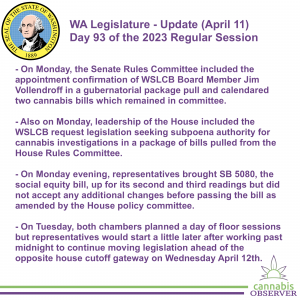

Board members learned more about environmental pesticide investigations and test results before hearing a proposal for a dedicated research unit at the agency and legislative updates.