The Washington State Citizen Commission for Performance Measurement of Tax Preferences (WA Commission for Measurement of Tax Preferences) was established by the 2006 Legislature (RCW 43.136). The seven-member Commission is made up of five appointees: two appointed by the House, two appointed by the Senate, and one appointed by the Governor; and two non-voting members: the State Auditor and the Chair of the Joint Legislative Audit and Review Committee (JLARC). Members serve four-year terms and may be reappointed to serve more than one term. The Legislature has defined a “tax preference” as an exemption, exclusion, or deduction from the base of a state tax; a credit against a state tax; a deferral of a state tax; or a preferential state tax rate. The Department of Revenue has on record about 600 such tax preferences. The Commission develops a schedule to review tax preferences, based on a ten year review schedule. The Commission also comments on the reviews which are conducted independently by JLARC staff.

Washington State Citizen Commission for Performance Measurement of Tax Preferences

(WA Commission for Measurement of Tax Preferences)

Public

Structural Relationships

-

Washington State Office of the Governor

(WA Governor) -

Washington State Citizen Commission for Performance Measurement of Tax Preferences

(WA Commission for Measurement of Tax Preferences)

Observations

DOH - Webinar - Medical Cannabis - Workshop

(September 15, 2023) - Summary

A mostly new team at the DOH Medical Cannabis Program solicited feedback on potential revisions to rules on compliant products, testing, labeling, and logos.

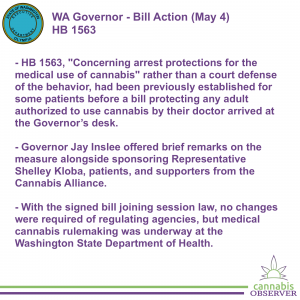

WA Governor - Bill Action

(May 4, 2023) - HB 1563

Legislation expanding arrest projections for medical cannabis patients reflected the diligence of an advocate who had been pushing for various reforms on medical policies for several years.

The Week Ahead

(May 1, 2023)

The Governor was scheduled to take action on two cannabis bills, including the social equity program expansion, while other bodies convened to consider regular session outcomes.

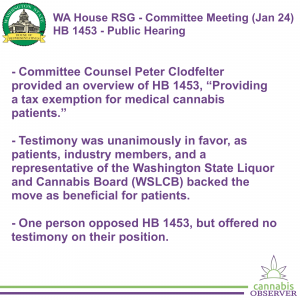

WA House RSG - Committee Meeting

(January 24, 2023) - HB 1453 - Public Hearing

Unanimously supportive testimony on a bill to remove the cannabis excise tax for medical patients registered with the state called attention to problems around taxing medicine.

The Week Ahead

(October 18, 2021)

A busy week inclusive of hearings on a local ban, medical cannabis taxation, social equity, and product testing would culminate in a legislative work session setting the stage for 2022.

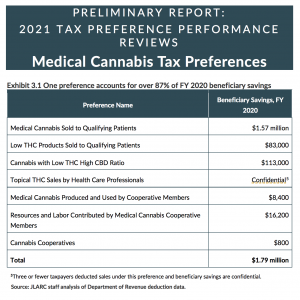

WA Commission for Measurement of Tax Preferences - Public Meeting

(September 9, 2021) - Medical Cannabis

A single patient offered testimony recommending sales tax breaks be reserved for registered patient purchases of DOH compliant products to incentivize “medical grade” production.

The Week Ahead

(September 6, 2021)

Summer is “officially” over as judged by policymaking on traceability, 2022 legislation, synthesized cannabinoids, and medical cannabis taxation in the week ahead.

WA Commission for Measurement of Tax Preferences - Public Meeting

(August 3, 2021) - Medical Cannabis

Commissioners learned about tax exemptions for medical patients and cooperatives, and the potentially dramatic impact of a statutory change redefining eligible cannabis purchases.

The Week Ahead

(August 2, 2021)

The agencies on the Cannabis Science Task Force were scheduled to describe their potential request legislation packages intended to create a new body for oversight of testing labs.

The Week Ahead

(May 3, 2021)

Deliberative work characteristic of the interim between legislative sessions began in earnest this week with social equity, medical marijuana, and behavioral health events on the calendar.