After undertaking significant activity on cannabis-related bills on Monday, lawmakers lined up executive sessions on a few more bills before the final policy committee deadline on Wednesday.

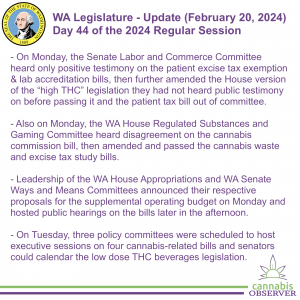

Here are some observations of the Washington State Legislature (WA Legislature) for Tuesday February 20th, the 44th day of the 2024 regular session.

My top 4 takeaways:

- On Monday, the Washington State Senate Labor and Commerce Committee (WA Senate LC) heard only positive testimony on the patient excise tax exemption and the lab accreditation bills, then further amended the House version of the “high THC” legislation they had not heard public testimony on before passing it and the patient tax bill out of committee.

- HB 1453 - “Providing a tax exemption for medical cannabis patients.”

- Positions (testifying + not testifying - duplicates = total)

- PRO: 8 + 141 - 7 = 142

- CON: 0 + 1 - 0 = 1

- OTHER: 0 + 0 - 0 = 0

- Committee members only heard positive testimony on legislation to exempt registered patients from paying the 37% excise tax on qualified medical cannabis products.

- The only person to sign in opposed to the legislation was Washington State Public Health Association (WSPHA) Executive Director Megan Moore.

- At the end of their meeting, the committee recommended the legislation to their peers in the Washington State Senate Ways and Means Committee (WA Senate WM) for fiscal analysis. The following members, all Republicans, voted against recommending the legislation:

- Republican Leader John Braun

- Senator Drew MacEwen

- Senator Mark Schoesler

- Positions (testifying + not testifying - duplicates = total)

- HB 2151 - “Reassigning the accreditation of private cannabis testing laboratories from the department of ecology to the department of agriculture.”

- Positions (testifying + not testifying - duplicates = total)

- PRO: 6 + 18 - 0 = 24

- CON: 0 + 0 - 0 = 0

- OTHER: 0 + 0 - 0 = 0

- Senators only heard positive testimony on the Washington State Department of Agriculture (WSDA) request legislation which emphasized the alignment of the Washington State Department of Ecology (DOE) with the transfer of responsibility.

- The bill was scheduled for an executive session on Tuesday February 20th with no amendments at publication time.

- Positions (testifying + not testifying - duplicates = total)

- HB 2320 - “Concerning high THC cannabis products.”

- Questionably, committee leadership did not schedule a public hearing for the substantially revised House version of the “high THC” bill.

- More questionably, Senator Drew Hansen introduced a striking amendment which committed the legislature to provide the Washington State Department of Health (DOH) “with recurring funding available each fiscal year…to issue requests for proposals and contract for targeted public health messages and social marketing campaigns“ and reversed the language passed nearly unanimously by Representatives which placed the Washington State Health Care Authority (WA HCA) in charge of developing “guidance and health interventions for health care providers and patients at risk for developing serious complications due to cannabis consumption.”

- When given the opportunity to explain his proposed revision, Hansen said nothing about the content of the changes, only offering that “the bill makes various requests, changes at the request of the bill sponsor,” Representative Lauren Davis. Chair Karen Keiser ensured her peers had heard Hansen’s curt remarks because she had perceived “a questionable, puzzled look over here” (audio < 1m, video - TVW).

- The striking amendment was adopted and the bill was recommended to WA Senate WM in a voice vote. The following members, all Republicans, voted the legislation be referred without recommendation:

- Ranking Member Curtis King

- Republican Leader John Braun

- Senator Mark Schoesler

- HB 1453 - “Providing a tax exemption for medical cannabis patients.”

- Also on Monday, the Washington State House Regulated Substances and Gaming Committee (WA House RSG) heard disagreement on the cannabis commission bill, then amended and passed the cannabis waste and excise tax study bills.

- SB 5546 - “Establishing a Washington state cannabis commission.”

- Positions (testifying + not testifying - duplicates = total)

- PRO: 10 + 46 - 3 = 53

- CON: 8 + 61 - 1 = 68

- OTHER: 1 + 0 - 0 = 1

- Testimony was sharply divided with those opposed inveighing against various bill requirements such as the necessity for 40% of producers and processors to participate in referenda for the results to be considered representative - which proponents explained was a 10% higher threshold than other commodity commissions, but opponents felt could lead to tyrannical exercise of minority rule.

- The legislation was scheduled for an executive session on Tuesday February 20th.

- Positions (testifying + not testifying - duplicates = total)

- SB 5376 - “Allowing the sale of cannabis waste.”

- Heard on Wednesday February 14th and following deferred executive action on Thursday February 15th, members amended and advanced the cannabis waste bill on Monday.

- Representative Kristine Reeves introduced her amendment as a way to ensure equitable access and enhanced transparency into sales of cannabis waste. Republicans resisted the amendment on the grounds that disposing of cannabis waste should be made easier, but the majority adopted the change.

- Co-Chair Shelley Kloba withdrew her earlier amendment in favor of a revision which would ensure that cannabis waste can be given away without being subject to the requirement that cannabis products must be sold above cost.

- The legislation was recommended by committee members and would likely be referred to the Washington State House Appropriations Committee (WA House APP) for fiscal consideration due to the costs projected by the Washington State Liquor and Cannabis Board (WSLCB).

- SB 6271 - “Modifying the cannabis excise tax to consider THC concentration.”

- Also heard on Wednesday February 14th, members made short work of advancing the “potency tax” study bill without amendment.

- It remained unclear where the legislation would be referred to next as it had been advanced in the Senate without undergoing fiscal committee consideration despite carrying a fiscal note from WSLCB exceeding the typical threshold of $50K which would prompt closer examination of the financial dimensions of a bill aiming to revise the highest cannabis excise tax in the world.

- SB 5546 - “Establishing a Washington state cannabis commission.”

- Leadership of the Washington State House Appropriations Committee (WA House APP) and the Washington State Senate Ways and Means Committee (WA Senate WM) announced their respective proposals for the supplemental operating budget on Monday and hosted public hearings on the bills later in the afternoon.

- HB 2104 - “Making 2023-2025 fiscal biennium supplemental operating appropriations.”

- SB 5950 - “Making 2023-2025 fiscal biennium supplemental operating appropriations.”

- The pivotal bills were both scheduled for executive sessions in the House and the Senate on Wednesday February 21st.

- On Tuesday, three policy committees were scheduled to host executive sessions on four cannabis-related bills and senators could calendar the low dose tetrahydrocannabinol (THC) beverages legislation.

- 10:30am: WA Senate LC - Committee Meeting [ Event Details ]

- Executive Session

- HB 2151 - “Reassigning the accreditation of private cannabis testing laboratories from the department of ecology to the department of agriculture.”

- At publication time, there were no proposed amendments on the legislation.

- HB 2151 - “Reassigning the accreditation of private cannabis testing laboratories from the department of ecology to the department of agriculture.”

- Executive Session

- ~12:45pm: Washington State Senate Rules Committee (WA Senate RULE) - Committee Meeting [ Event Details ]

- On Monday afternoon, legislative staff announced that WA Senate RULE members would meet at the rostrum after the Senate pro forma floor session scheduled to begin at 12:30pm. The committee would have the opportunity to vote to calendar one regular and one gubernatorial package of bills compiled by leadership.

- At publication time, one cannabis bill had been recommended to the committee and could be selected for calendaring:

- HB 1249 - “Regarding limits on the sale and possession of retail cannabis products.”

- 4pm: Washington State House Community Safety, Justice, and Reentry Committee (WA House CSJR) - Committee Meeting [ Event Details ]

- Executive Session

- SB 6133 - “Deterring robberies from cannabis retail establishments.”

- Chair Roger Goodman published a striking amendment which would appear to narrow applicability of the sentencing enhancement to “crash and grab” operations and grant prosecutors discretion to apply the special allegation.

- SB 6133 - “Deterring robberies from cannabis retail establishments.”

- Executive Session

- 4pm: WA House RSG - Committee Meeting [ Event Details ]

- Executive Session

- SB 5546 - “Establishing a Washington state cannabis commission.”

- Amendment CLOD 286 by Co-Chair Kloba “Provides that under the initial rate of assessment on a licensed cannabis producer or licensed cannabis producer/processor to fund the Washington State Cannabis Commission, the assessment may not exceed $5,000 per licensee.”

- At an initial rate of 0.29%, this amendment would protect producers and processors who gross more than ~$1.72M in “sales revenue” annually from paying a higher assessment to help fund a commission.

- Amendment CLOD 286 by Co-Chair Kloba “Provides that under the initial rate of assessment on a licensed cannabis producer or licensed cannabis producer/processor to fund the Washington State Cannabis Commission, the assessment may not exceed $5,000 per licensee.”

- SB 5363 - “Concerning cannabis retailer advertising.”

- At publication time, there were no proposed amendments on the legislation.

- SB 5546 - “Establishing a Washington state cannabis commission.”

- Executive Session

- 10:30am: WA Senate LC - Committee Meeting [ Event Details ]