All three cannabis bills at risk were scheduled for executive sessions before the fiscal committee cutoff on Monday, although two carried potential amendments which could alter their outcomes.

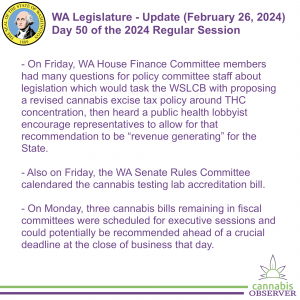

Here are some observations of the Washington State Legislature (WA Legislature) for Monday February 24th, the 50th day of the 2024 regular session.

My top 3 takeaways:

- On Friday, Washington State House Finance Committee (WA House FIN) members had many questions for policy committee staff about legislation which would task the Washington State Liquor and Cannabis Board (WSLCB) with proposing a revised cannabis excise tax policy around tetrahydrocannabinol (THC) concentration, then heard a public health lobbyist encourage representatives to allow for that recommendation to be “revenue generating” for the State.

- SB 6271 - “Modifying the cannabis excise tax to consider THC concentration.”

- Positions (testifying + not testifying - duplicates = total)

- PRO: 1 + 2 - 0 = 3

- CON: 0 + 2 - 0 = 2

- OTHER: 0 + 0 - 0 = 0

- Washington State House Regulated and Substances and Gaming Committee (WA House RSG) Counsel Peter Clodfelter provided a briefing on the legislation which would require WSLCB staff to devise a “revenue neutral” tax policy proposal aiming to diminish higher THC cannabis product use (audio - 2m, video - TVW).

- Majority Whip Alex Ramel asked about potential interplay with HB 2320 (“Concerning high THC cannabis products”) as he seemed to be under the impression that legislators may prohibit access to certain cannabis products within the regulated market, thereby complicating revenue projections (audio - 3m, video - TVW).

- Ranking Minority Member Ed Orcutt asked if patients utilized higher THC products and confirmed the legislation had no provisions requiring WSLCB staff to consider patient needs (audio - 1m, video - TVW).

- Representative Amy Walen seemed confused that lawmakers would ask a regulatory agency to devise tax policy, prompting Clodfelter to remind members that their predecessors approved a $100K budget proviso in 2019 asking the WSLCB to convene a Potency Tax Work Group to determine the feasibility of developing an excise tax tied to cannabis product THC concentration (audio - 2m, video - TVW).

- Chair April Berg confirmed that the work group recommended against implementing a “substantially similar” tax scheme at that time, and Clodfelter explained how the legislation under consideration took a slightly different approach by mandating data collection to inform a proposal (audio - 1m, video - TVW).

- Orcutt confirmed the work group would not be reconstituted to assist WSLCB in making the recommendation (audio < 1m, video - TVW).

- Berg concluded questioning by clarifying the work group did not recommend pursuing a tax by THC concentration at that time, which Clodfelter confirmed, highlighting concerns about “unknown benefits and known costs” (audio - 1m, video - TVW).

- Washington State Public Health Association (WSPHA) Lobbyist Amy Brackenbury noted her organization’s parallel support for HB 2320 as they felt the bills “work together.” While signed in to support the legislation, her group sought a “robust” study but advocated for faster turnaround. Brackenbury also felt mandating a revenue neutral recommendation kept the bill “too narrow.” Finally, she sought to have “public health researchers and stakeholders” included in the study in order for WSPHA “to continue to support the bill” (audio - 2m, video - TVW).

- WSPHA Executive Director Megan Moore signed in opposed to HB 1453 (“Providing a tax exemption for medical cannabis patients”) as well as HB 2194 (“Legalizing the home cultivation of cannabis”) but in neither case offered testimony to publicly explain their members’ formal opposition to the legislation.

- Moore formerly worked as the Kitsap Public Health District Community Liaison and helped facilitate the formation of Prevention Voices in 2020. Before the 2021 regular session, she organized a dedicated Washington State Legislative Information Center (WA LIC) training for the informal coalition which she described as “substance use prevention professionals who are just here to educate about youth substance use prevention" and who were not “lobbyists.”

- Later on Friday, the legislation was scheduled for an executive session during the committee’s last meeting of the 2024 regular session on Monday February 26th.

- On Sunday afternoon, a committee striking amendment was published which granted the WSPHA all of their requests in addition to other substantial changes:

- Directs the DOR, rather than the LCB, to formulate a recommended approach and implementation plan for modifying the cannabis excise tax relative to THC concentration.

- Requires the DOR to consult with the LCB, the DOH, and public health professionals.

- Requires the DOR to consider the relationship between product type, sales volume, THC concentration, total THC, and price in developing the recommendations.

- Directs consideration of revenue additions and revenue-neutral options compared to current cannabis tax revenues, rather than be strictly revenue neutral.

- Changes the start date for LCB data collection to July 1, 2024.

- Requires the LCB to report the data to the legislature and to DOR by July 31, 2025.

- Requires the DOR to submit their recommendations to the legislature by December 31, 2025.

- Expires the act July 1, 2026.

- Positions (testifying + not testifying - duplicates = total)

- SB 6271 - “Modifying the cannabis excise tax to consider THC concentration.”

- Also on Friday, the Washington State Senate Rules Committee (WA Senate RULE) calendared the cannabis testing lab accreditation bill.

- HB 2151 - “Reassigning the accreditation of private cannabis testing laboratories from the department of ecology to the department of agriculture.”

- The legislation was included among the package of bills to be added to the consent calendar as approved by members.

- The consent calendar collects bills “that are probably not controversial” for second and third reading, in contrast to the regular calendar.

- As the legislation was not modified in the Senate, floor action would constitute final passage of the Washington State Department of Agriculture (WSDA) request legislation.

- The legislation was included among the package of bills to be added to the consent calendar as approved by members.

- HB 2151 - “Reassigning the accreditation of private cannabis testing laboratories from the department of ecology to the department of agriculture.”

- On Monday, three cannabis bills remaining in fiscal committees were scheduled for executive sessions and could potentially be recommended ahead of a crucial deadline at the close of business that day.

- 8am: WA House FIN - Committee Meeting [ Event Details ]

- Executive Session

- SB 6271 - “Modifying the cannabis excise tax to consider THC concentration.”

- The committee striking amendment, if adopted and subsequently passed by House members, would necessitate a concurrence/dispute vote in the Senate.

- SB 6271 - “Modifying the cannabis excise tax to consider THC concentration.”

- Executive Session

- 10am: Washington State Senate Ways and Means Committee (WA Senate WM) - Committee Meeting [ Event Details ]

- Executive Session

- HB 1453 - “Providing a tax exemption for medical cannabis patients.”

- On Saturday February 24th, legislative staff announced an executive session on the legislation had been scheduled for the committee’s Monday meeting.

- On Sunday February 25th, a striking amendment by Chair June Robinson was published which was described as having the following effects:

- “Expires the cannabis excise tax exemption for medical cannabis patients and designated providers on January 1, 2034, requires a tax preference performance review by the joint legislative audit and review committee; and requires the joint legislative audit and review committee submit an initial report to the legislature by December 1, 2029.”

- The change would remove language introduced by Representative Sharon Wylie by amendment during a House fiscal committee executive session in 2023. The change would also introduce new, unestimated costs from the Washington State Joint Legislative Audit and Review Committee (JLARC) in future bienniums. If adopted and subsequently passed in the Senate, the legislation would require a concurrence/dispute vote in the House.

- HB 1453 - “Providing a tax exemption for medical cannabis patients.”

- Executive Session

- 10:30am: Washington State House Appropriations Committee (WA House APP) - Committee Meeting [ Event Details ]

- Executive Session

- SB 5376 - "Allowing the sale of cannabis waste."

- At publication time, there were no published amendments on the legislation.

- SB 5376 - "Allowing the sale of cannabis waste."

- Executive Session

- At the close of business, the Legislature would mark the Opposite House Fiscal Committee Cutoff deadline, the fifth gateway most legislation must be passed through to continue being advanced during the regular session.

- Legislation can be declared "necessary to implement budgets" (NTIB), an informal procedure leadership can exercise around any bill with a fiscal impact.

- For the remainder of the week, both chambers would convene floor sessions to debate, amend, and pass legislation before the Opposite House Cutoff on Friday March 1st at 5pm PT.

- Then, both chambers would convene floor sessions in the final sprint before sine die marking the end of the 2024 regular session on Thursday March 7th.

- 8am: WA House FIN - Committee Meeting [ Event Details ]