One cannabis bill was gathering signatures, another was ready for final passage, three were in rules awaiting calendaring, and three more were scheduled for execs before the Monday cutoff.

Here’s a look at cannabis-related policymaking events on the calendar in the week ahead.

Monday February 26th

WA House FIN - Committee Meeting

On Monday at 8am PT, the Washington State House Finance Committee (WA House FIN) was scheduled to convene.

- [ Event Details ]

- Executive Session

- SB 6271 - “Modifying the cannabis excise tax to consider THC concentration.”

- On Friday, WA House FIN members had many questions for policy committee staff about legislation which would task the Washington State Liquor and Cannabis Board (WSLCB) with proposing a revised cannabis excise tax policy around tetrahydrocannabinol (THC) concentration, then heard a public health lobbyist encourage representatives to allow for that recommendation to be “revenue generating” for the State.

- On Sunday afternoon, a committee striking amendment was published which would substantially alter the bill:

- Directs the DOR, rather than the LCB, to formulate a recommended approach and implementation plan for modifying the cannabis excise tax relative to THC concentration.

- Requires the DOR to consult with the LCB, the DOH, and public health professionals.

- Requires the DOR to consider the relationship between product type, sales volume, THC concentration, total THC, and price in developing the recommendations.

- Directs consideration of revenue additions and revenue-neutral options compared to current cannabis tax revenues, rather than be strictly revenue neutral.

- Changes the start date for LCB data collection to July 1, 2024.

- Requires the LCB to report the data to the legislature and to DOR by July 31, 2025.

- Requires the DOR to submit their recommendations to the legislature by December 31, 2025.

- Expires the act July 1, 2026.

- SB 6271 - “Modifying the cannabis excise tax to consider THC concentration.”

WA Senate WM - Committee Meeting

On Monday at 10am PT, the Washington State Senate Ways and Means Committee (WA Senate WM) was scheduled to convene.

- [ Event Details ]

- Executive Session

- HB 1453 - “Providing a tax exemption for medical cannabis patients.”

- Before hearing only positive testimony on the patient excise tax exemption bill, Chair June Robinson asked staff to reiterate the analysis from Washington State Liquor and Cannabis Board (WSLCB) staff that patient purchases could be estimated to contribute 1% of cannabis excise tax revenue to the State, lingering on the $5M figure.

- The more recent WSLCB fiscal note where this analysis was highlighted glossed two important facts:

- Retail sales and use tax exemptions have generally been offered to authorized patients as well as individuals who take the extra step of registering with DOH.

- Retail sales and use tax exemptions have generally been offered to patients purchasing any cannabis products.

- The initial WSLCB fiscal note from 2023 used data reported by retailers to more directly calculate the tax revenue collected by the State through actual sales of DOH-compliant cannabis products to registered patients, coming up with a figure vanishingly smaller than the subsequent $5M estimate.

- “Based on data from the Liquor and Cannabis Board's ("Board") Cannabis Central Reporting System ("CCRS"), the cannabis sales that were sales of DOH compliant cannabis products to recognition cardholders was $541 during the 4th quarter of 2022 (Sept-Dec 2022). Extrapolating that out to a year's worth of sales would equal $2,164 in taxable sales that met the criteria in the bill. Applying the 37% tax to these sales comes up with an estimated $801 per year in cannabis excise tax that would be lost under this bill.”

- The more recent WSLCB fiscal note where this analysis was highlighted glossed two important facts:

- On Sunday February 25th, Robinson published a striking amendment which would expire the tax preference and require review, attaching new costs to the bill.

- Before hearing only positive testimony on the patient excise tax exemption bill, Chair June Robinson asked staff to reiterate the analysis from Washington State Liquor and Cannabis Board (WSLCB) staff that patient purchases could be estimated to contribute 1% of cannabis excise tax revenue to the State, lingering on the $5M figure.

- HB 1453 - “Providing a tax exemption for medical cannabis patients.”

WA House APP - Committee Meeting

On Monday at 10:30am PT, the Washington State House Appropriations Committee (WA House APP) was scheduled to convene.

- [ Event Details ]

- Executive Session

- SB 5376 - "Allowing the sale of cannabis waste."

WA Legislature - Opposite House Fiscal Committee Cutoff

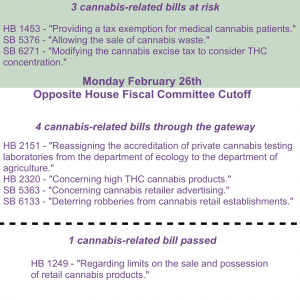

On Monday, the Washington State Legislature (WA Legislature) would mark the Opposite House Fiscal Committee Cutoff deadline.

- [ Cutoff Calendar ]

- The fifth gateway that most cannabis bills must be shepherded through would occur on Monday and was described as the “Last day to read in opposite house committee reports (pass bills out of committee and read them into the record on the floor) from House fiscal committees and Senate Ways & Means and Transportation committees.”

- Legislation can be declared "necessary to implement budgets" (NTIB), an informal procedure leadership can exercise around any bill with a fiscal impact. The criteria for NTIB status and the decision making around the designation hadn’t been set in law or rule, allowing for a bypass of the cutoff calendar which is otherwise agreed to by both chambers through the legislative process.

- At publication time, three cannabis-related bills remained at risk, having not been recommended by chamber fiscal committees - but all were calendared for executive sessions on Monday:

- For the remainder of the week, both chambers would convene floor sessions to debate, amend, and pass legislation before the Opposite House Cutoff on Friday March 1st at 5pm PT.

Tuesday February 27th

On Tuesday, the WA House was scheduled to convene starting at 9am PT and the WA Senate at 9am PT.

WSLCB - Board Caucus

On Tuesday at 10am PT, the weekly Washington State Liquor and Cannabis Board (WSLCB) Board Caucus was scheduled to recur.

- [ Event Details ]

WA HCA - DBHR Listening Session

On Tuesday at 1:30pm PT, the monthly Washington State Health Care Authority (WA HCA) Division of Behavioral Health and Recovery (DBHR) Behavioral Health Service Provider Listening Session was scheduled to recur.

- [ Event Details ]

Wednesday February 28th

On Wednesday, the WA House was scheduled to convene starting at 10am PT and the WA Senate at 10am PT.

WSLCB - Board Meeting

On Wednesday at 10am PT, the bi-weekly WSLCB Board Meeting was scheduled to recur.

- [ Event Details ]

Thursday February 29th

On Thursday, the WA House was scheduled to convene starting at 9am PT and the WA Senate at 9am PT.

DOH - Webinar - Medical Cannabis - Workshop

On Thursday at 1pm PT, Washington State Department of Health (DOH) staff planned to host a webinar workshop on the Medical Cannabis rulemaking project.

- [ Event Details, Rulemaking Project ]

- In the announcement, DOH staff indicated their intent to continue collaboratively revising the medical cannabis program code, indicating “Participants will provide feedback on draft language, recommendations, and policy questions for two sections of rule: Definitions under WAC 246-70-030 and Product Categories (General, HighCBD, High-THC) under WAC 246-70-040.”

Friday March 1st

On Friday, the WA House was scheduled to convene starting at 9:30am PT and the WA Senate at 10am PT.

WA Pharmacy Commission - Legislative Review

On Friday at 12pm PT, the weekly Washington State Pharmacy Quality Assurance Commission (WA Pharmacy Commission) Legislative Review was scheduled to recur.

- [ Event Details ]

WA Legislature - Opposite House Cutoff

On Friday at 5pm PT, the WA Legislature would mark the Opposite House Cutoff deadline.

- [ Cutoff Calendar ]

- The sixth gateway that most cannabis bills must be shepherded through would occur on Friday and was described as the “Last day to consider (pass) opposite house bills (5 p.m.) (except initiatives and alternatives to initiatives, budgets and matters necessary to implement budgets, differences between the houses, and matters incident to the interim and closing of the session).”

- Legislation can be declared "necessary to implement budgets" (NTIB).

- Following the cutoff, both chambers would convene floor sessions to debate, amend, and pass legislation before Sine Die on Thursday March 7th, the “Last day allowed for regular session under state constitution.”

Saturday March 2nd

On Saturday, the WA House was potentially scheduled to convene starting at 9am PT.

Sunday March 3rd

On Sunday, the WA House was potentially scheduled to convene starting at 1pm PT.