Staff provided updates on rulemaking projects and previewed presentations set for the following day on THC serving size, lab authority, and a patient excise tax exemption.

Here are some observations from the Tuesday July 16th Washington State Liquor and Cannabis Board (WSLCB) Board Caucus.

My top 4 takeaways:

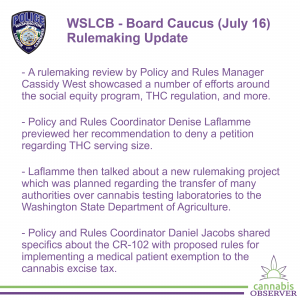

- A rulemaking review by Policy and Rules Manager Cassidy West showcased a number of efforts around the social equity program, tetrahydrocannabinol (THC) regulation, and more.

- SB 5080 Implementation (audio - 1m, video - TVW, Rulemaking Project)

- West established that a previously mentioned survey on the draft rules for the project to modify the equity program would stay open online until Thursday July 18th. Responses would inform their revisions, she told board members, and the survey had been “developed based on feedback that we had received after our initial engagement sessions” on May 15th and 22nd.

- Board Chair Postman suggested making the survey link more prominent on the agency website (audio - 1m, video - TVW).

- Later that morning, officials updated messaging sharing the survey to their laws and rules page, the equity program landing page, as well as a blog post reminder..

- Board Member Ollie Garrett was curious about the response rate: “are we getting responses compared to what it was like in the past?” West was unsure, but Justin Nordhorn, Director of Policy and External Affairs, indicated he’d spoken with the research staff monitoring the responses. “As of yesterday, we had 100 responses,” said Nordhorn, sharing his expectation there would be more before the survey was closed. Staff would also “take a look at the duplicates. And so if somebody were to take it twice, we'd be able to identify that and set those aside,” he reported, summing up the response rate as “good, widespread.” Postman reiterated the importance of this chance for public contribution to the rule draft. Garrett believed the responses were “more than double” a previous survey which she felt was a sign their work “trying to reach more people must have been successful to a degree” (audio - 2m, video - TVW).

- West added that a CR-102 with proposed rules was still anticipated to be ready for the July 31st board meeting (audio - <1m, video - TVW).

- SB 5367 Implementation (audio - <1m, video - TVW, Rulemaking Project)

- West relayed that a CR-102 on the THC regulation law would also be presented on July 31st.

- Staff hosted focus groups on the project throughout December 2023, as well as seven more in 2024, with the most recent on May 2nd.

- Payments Flexibility (audio - <1m, video - TVW, Rulemaking Project)

- Another CR-102 West expected would be prepared for members at the July 31st board meeting, she reminded them it was a petition they’d accepted on May 8th regarding “flexibility for mailing checks” for payment between cannabis licensees.

- Staff had reported the CR-102 would be ready on July 17th, along with a presentation for the Minors on Wholesale Licensed Premises rulemaking project, though the projects weren’t included in the agenda.

- Another CR-102 West expected would be prepared for members at the July 31st board meeting, she reminded them it was a petition they’d accepted on May 8th regarding “flexibility for mailing checks” for payment between cannabis licensees.

- Cannabis Waste (audio - <1m, video - TVW, Rulemaking Project)

- Looking ahead to the August 14th board meeting, West said a CR-102 about the sale of plant waste material was on track to be presented and emphasized “we are accepting comments if anybody has any comments.”

- Social Equity License Mobility (audio - 1m, video - TVW)

- West said Policy and Rules Coordinator Daniel Jacobs would be “presenting a petition…related to social equity license mobility.”

- Three petitions on the topic had been accepted as part of SB 5080 rulemaking by board members on June 18th. At time of publication, no mention of further petitions about license mobility had been made publicly.

- SB 5080 Implementation (audio - 1m, video - TVW, Rulemaking Project)

- Policy and Rules Coordinator Denise Laflamme previewed her recommendation to deny a petition regarding THC serving size (audio - 3m, video - TVW).

- Laflamme began by saying her presentation set for the Wednesday July 17th board meeting would include a recommendation for “denying the petition for rulemaking because we believe what is being asked is unwarranted given available products and also implementation of recent legislation.”

- “On May 20, 2024, Tanner Odenthal submitted a petition for rulemaking requesting the board to amend WAC 314-55-095 to increase the existing ten milligram THC serving limit for cannabis edibles,” Laflamme explained. Odenthal raised concerns that the limit “in edibles is not effective for medical users, as many locations do not carry high THC DOH [Washington State Department of Health] compliant products.” His arguments also reflected how “edibles with higher THC serving limit would give medical users access to safe and standard doses without having to make their own higher dose edibles from concentrates.”

- Under WAC 314-55-095, “LCB defines the single serving of a cannabis infused products as not containing more than ten milligrams THC,” said Laflamme, and in “WAC 246-17-040 DOH defines high THC compliant products, as containing between 10 and 50 milligrams of active THC, but only for certain types of products.”

- Laflamme recognized there had been a “low supply of DOH compliant products available,” but countered a 2024 law exempting patients from paying an excise tax on compliant items meant regulators were “expecting the number of these products to increase.” She planned to go into greater detail about the difference between adult use cannabis and medically compliant products during the board meeting, along with “some concerns about increasing the THC limit for…noncompliant edible[s].”

- Postman raised a “sequence question” about whether it would be reasonable to accept the petition since “it wouldn't happen until after all these other things we're working on about medical” policy. Laflamme concurred, mentioning that DOH leaders had “their rulemaking open and they are considering looking at these products also” (audio - 1m, video - TVW).

- DOH officials have a medical cannabis workshop scheduled for Thursday July 18th.

- Laflamme then talked about a new rulemaking project which was planned regarding the transfer of many authorities over cannabis testing laboratories to the Washington State Department of Agriculture (WSDA, audio - 3m, video - TVW).

- Although a 2019 law set a deadline for accreditation of cannabis testing laboratories to be moved from WSLCB to the Washington State Department of Ecology (DOE) by July of 2024, lawmakers decided to shift that transfer through passage of HB 2151 (“Reassigning the accreditation of private cannabis testing laboratories from the department of ecology to the department of agriculture”).

- WSDA staff led a webinar on the change on March 14th, the day after it was signed into law.

- Laflamme offered a preview of the CR-101 to begin the project, remarking that in addition to HB 2151 the project would include changes from HB 1859 (passed in 2022) and reflect “new rules related to the transfer of these activities that became effective earlier this year” at WSDA. The rules were needed to “clarify LCB's activities with the transfer.”

- WSDA announced a rulemaking effort for lab standards in January 2023 and in November 2023, proposed rules in the CR-102 were provided along with separate standard method documents. An initial public hearing was held in December 2023. Following a second CR-102 on February 21st, a second public hearing was held April 9th and the CR-103 rule changes were adopted by the department on April 17th.

- The lab accreditation rulemaking project at WSDA started with webinars on March 14th and 27th as HB 2151 was passed. Rule text was released ahead of expedited rulemaking the department initiated on April 17th, and adopted on June 18th. Find out more from a July 8th transition summary from WSLCB.

- With board approval of a CR-101, Laflamme forecast the timeline for the project would feature:

- “An informal comment period until August 16th.”

- “We plan on holding stakeholder engagement sessions later in August, and plan to have proposed rules by September 25th.”

- “Assuming all goes well, the final rules would be filed on November 20th, becoming effective on December 21st.”

- Although a 2019 law set a deadline for accreditation of cannabis testing laboratories to be moved from WSLCB to the Washington State Department of Ecology (DOE) by July of 2024, lawmakers decided to shift that transfer through passage of HB 2151 (“Reassigning the accreditation of private cannabis testing laboratories from the department of ecology to the department of agriculture”).

- Policy and Rules Coordinator Daniel Jacobs shared specifics about the CR-102 with proposed rules for implementing a medical patient exemption to the cannabis excise tax (audio - 5m, video - TVW, Rulemaking Project).

- Patients who registered with DOH have been exempt from paying the sales and use tax on cannabis. HB 1453 expanded this exemption to the 37% excise tax but limited its application to products certified as DOH compliant.

- Jacobs gave a brief background on the law before outlining steps the project would going through if board members approved the CR-102 at the following day’s board meeting:

- There would “be a public comment period open until the public hearing which will be held on August 28th.”

- “Assuming that goes well, the [CR-103 would] be presented September 11th.”

- New rules would take “effect October 12th.”

- Acknowledging that the tax exemption was limited to registered patients procuring compliant items, Jacobs further specified retailers also had to hold a medical cannabis endorsement in order to offer the exemption. Additionally, “LCB is provided rulemaking authority to identify what records retailers need to hold on to in order to demonstrate that these requirements are met.” He commented that an “excise tax reporting form has been changed accordingly,” adding the exemption was set to expire at the end of June 2029.

- Jacobs referred to guidance on HB 1453 WSLCB staff had distributed, as well as an excise tax infographic and Medically Compliant Packaging and Labeling Guidance. Nonetheless, he cautioned that “rule language isn't going to be effective until October 12th at the earliest.” Jacobs advised that these documents should be regarded as “related to the rulemaking but aren't necessarily the exact same thing as the rulemaking.”

- According to the memorandum, the changes included both new rule language related to HB 1453 plus some related changes to existing rules. Jacobs mentioned that revisions involved:

- Amending “three existing rule sections to address this new excise tax exemption, including 314-55-083 on traceability 314-55-087 on record keeping requirements, and 314-55-089 on tax…reporting. All these rules have been amended to address the new requirements as well as make some minor tweaks that have been needed to be made for a while.”

- “We are creating a new rule entirely dedicated to this new tax exemption that we're numbering as 314-55-090.”

- Retailers would be required to keep records such as “date of the sale, certain information from the patient recognition card, which product is being sold in the excise taxes being exempted from, and the sales price. All this data is going to be used in the event of an audit.”

- Jacobs concluded by noting there were “some other technical details about the rulemaking that I'll be happy to go into more detail on tomorrow.”

- Board Member Jim Vollendroff brought up the positive feedback he’d gotten “from both external partners and internal staff about the communication about this particular change.” He passed on the appreciation he’d received from others on “the work that's been done to communicate this.” Jacobs said it was a collaborative effort with several agency divisions and they had “been getting a lot of questions from folks about it.” He also credited DOH staff for being able to answer questions on product compliance, adding their staff were “really, really great to work with” (audio - 1m, video - TVW).

- Nordhorn chimed in to say “we're setting up a tentative date for Monday, July 29th, to do an industry question and answer session” webinar. He believed an invite would be sent out by the end of the week covering “both the tax piece and the packaging labeling piece” (audio - 1m, video - TVW).