After fiscal committee work and announcement of schedules for the remainder of the week before cutoff, only two of 22 active cannabis bills appeared at risk of being left behind.

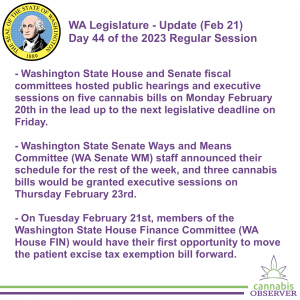

Here are some observations of the Washington State Legislature (WA Legislature) for Tuesday February 21st, the 44th day of the 2023 Regular Session.

My top 3 takeaways:

- Washington State House and Senate fiscal committees hosted public hearings and executive sessions on five cannabis bills on Monday February 20th in the lead up to the next legislative deadline on Friday.

- HB 1453 - “Providing a tax exemption for medical cannabis patients.”

- On Monday, members of the Washington State House Finance Committee (WA House FIN) heard only favorable testimony on legislation to exempt registered patients from the excise tax on qualifying product purchases.

- Positions (testifying + not testifying - duplicates = total)

- PRO: 5 + 48 - 1 = 52

- CON: 0

- OTHER: 0

- SB 5546 - “Establishing a Washington state cannabis commission.”

- In the Washington State Senate Ways and Means Committee (WA Senate WM) on Monday, members heard two bills beginning with legislation to establish a cannabis agricultural commodity commission. Despite an earlier amendment to enable producer-driven referenda for establishment of the commission and modification of the assessment, certain interests remained opposed to the legislation.

- Positions (testifying + not testifying - duplicates = total)

- PRO: 5 + 43 = 48

- CON: 4 + 34 = 38

- OTHER: 1 = 1

- SB 5377 - “Concerning cannabis license ownership.”

- A public hearing was then hosted on the out-of-state ownership + “inactive” producer suspension bill which elicited opposition from interests who aimed to prioritize the launch of the social equity program.

- Positions (testifying + not testifying - duplicates = total)

- PRO: 6 + 17 = 23

- CON: 2 + 33 - 1 = 34

- OTHER: 0

- SB 5080 - “Expanding and improving the social equity in cannabis program.”

- Working into the early evening, senators also hosted executive sessions on two cannabis bills. Senator Rebecca Saldaña, the prime sponsor of the social equity legislation, successfully amended her bill to make technical corrections and add seemingly non-binding suggestions for ways local authorities could mitigate concerns about retailer “density.” But Senator Ann Rivers called out Saldaña’s second amendment for lowering the State minimum buffer zone around schools and parks, seemingly prompting its early withdrawal. Rivers subsequently withdrew her own amendment before the bill was recommended out of committee and passed to the Washington State Senate Rules Committee (WA Senate RULE) for calendaring.

- SB 5376 - “Allowing the sale of cannabis waste.”

- Much less controversial, legislation authorizing producers to sell plant matter rather than render it for the landfill sailed through its senate fiscal committee without modification, remaining untouched since introduction.

- HB 1453 - “Providing a tax exemption for medical cannabis patients.”

- Washington State Senate Ways and Means Committee (WA Senate WM) staff announced their schedule for the rest of the week, and three cannabis bills would be granted executive sessions on Thursday February 23rd.

- SB 5546 - “Establishing a Washington state cannabis commission.”

- At publication time, there were no proposed amendments.

- SB 5377 - “Concerning cannabis license ownership.”

- At publication time, there were no proposed amendments.

- SB 5367 - "Concerning the regulation of products containing THC."

- On Saturday February 18th, senators heard divided testimony on WSLCB request legislation regarding THC limits on hemp consumables. Several testifiers blamed poor cannabis market conditions on competition from unregulated hemp products and claimed the bill would increase cannabis tax revenue.

- At publication time, there were no proposed amendments.

- The following bills had been referred to WA Senate WM but did not have public hearings scheduled at publication time:

- SB 5154 - “Improving Washington's solid waste management outcomes.”

- The House version of this bill, HB 1131, was scheduled for an executive session in the Washington State House Appropriations Committee (WA House APP) on Thursday February 23rd.

- SB 5259 - “Ensuring commerce and workplaces are safe from product theft.”

- SB 5154 - “Improving Washington's solid waste management outcomes.”

- SB 5546 - “Establishing a Washington state cannabis commission.”

- On Tuesday February 21st, members of the Washington State House Finance Committee (WA House FIN) would have their first opportunity to move the patient excise tax exemption bill forward.

- Originally and still also scheduled for Wednesday February 22nd, representatives planned to host an executive session on HB 1453 (“Providing a tax exemption for medical cannabis patients”) on Tuesday.

- Prime sponsor Sharon Wylie had proposed an amendment which was described as excluding “the exemption of medical cannabis sales from the cannabis excise tax from tax preference performance requirements, JALRC [sic] review, and 10 year expiration.”