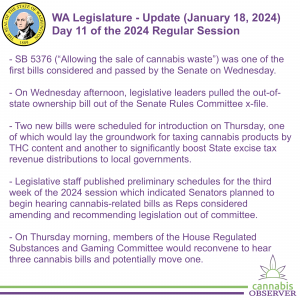

Senators passed the cannabis waste bill and revived out-of-state ownership; new tax bills were coming; the preliminary schedule was published; and 3 hearings were up Thursday morning.

Here are some observations of the Washington State Legislature (WA Legislature) for Thursday January 18th, the 11th day of the 2024 regular session.

My top 5 takeaways:

- SB 5376 (“Allowing the sale of cannabis waste”) was one of the first bills considered and passed by the Washington State Senate on Wednesday.

- During the planned floor session starting at 1:30pm, legislators placed SB 5376 at the top of the second order of consideration. Senator Derek Stanford, the primary sponsor of the legislation, motioned for adoption of the substitute bill which had been amended and recommended by the Washington State Senate Labor and Commerce Committee (WA Senate LC) in 2023.

- Senators passed the legislation unanimously with one excused.

- On Wednesday afternoon, legislative leaders pulled the out-of-state ownership bill out of the Senate Rules Committee x-file.

- During the first more formal meeting of the Washington State Senate Rules Committee (WA Senate RULE), Majority Leader Andy Billig presented a procedural motion to pull SB 5377 (“Concerning cannabis license ownership”) out of the x-file to make the legislation available for subsequent committee action. He indicated that Senator Ann Rivers, prime sponsor of the legislation, had sought out the consent of Senate President Denny Heck to reactivate the bill, which had been granted in his role as Chair of the committee.

- Members accepted the motion via voice vote.

- Two new bills were scheduled for introduction on Thursday, one of which would lay the groundwork for taxing cannabis products by THC content and another to significantly boost State excise tax revenue distributions to local governments.

- SB 6271 - “Modifying the cannabis excise tax to consider THC concentration.”

- President Pro Tempore Karen Keiser and Senator Derek Stanford planned to introduce legislation which would require the Washington State Liquor and Cannabis Board (WSLCB) to collect and report on data regarding the tetrahydrocannabinol (THC) concentration in regulated cannabis products, then “formulate a recommended approach and implementation plan for modifying the cannabis excise tax.” The recommendation and “proposed modifications must be revenue neutral and propose a higher tax on products with a higher THC concentration relative to other products in the same category.”

- In 2019, legislators asked WSLCB to convene a work group “to determine the feasibility of and make recommendations for varying the marijuana excise tax rate based on product potency.” I served on that work group which issued a final report finding “...a change to a potency-based tax would not be feasible at this time, despite some members being interested in the potential of the concept. The consultant team at BOTEC came to a similar conclusion, noting that “a potency tax is likely to affect consumer purchasing habits to an unknown extent, and it is currently impossible to quantify any public health gains resulting from those effects. It is not feasible to estimate the potential long-term revenue changes afforded by a switch from ad valorem to a potency tax. However, the considerable costs relating to the implementation of a cannabis potency tax in Washington State, as well as both theoretical and practical challenges in doing so, are better known. Therefore, at present, any change in the tax structure would require embracing large known costs and additional unknown costs in exchange for unknown benefits.”

- SB 6272 - “Dedicating the state share of cannabis excise tax revenue to counties and cities.”

- Senator Mark Mullet, who is a democratic candidate for Governor, planned to introduce legislation to substantially boost cannabis excise tax distributions to local governments, 50% of which would be “solely for attracting and retaining additional commissioned law enforcement officers” and the remainder for “criminal justice purposes.”

- Significantly revising complicated standing appropriations in RCW 69.50.540 which allocate a remaining subset of State revenue from the sale of cannabis products wherein counties and cities already receive approximately 5% of what’s left, Mullet’s bill proposed to distribute 32% of remaining funds to local governments - money which previously had been earmarked for transfer into the State General Fund.

- Mullet chaired the Washington State Joint Legislative Audit and Review Committee (JLARC) which oversaw and approved the final staff report on Appropriations and Expenditures of the Dedicated Cannabis Account on January 4th. After hearing a preliminary report on November 29th, Mullet raised questions about health care “entitlement” spending and prevention funding promised in Initiative 502 which legislators themselves had subsequently lowered, but did not ask about local government appropriations nor a State requirement that revenue be dedicated to law enforcement.

- In the same JLARC meeting in November, Republican Senator Keith Wagoner said he had been underwhelmed by the “paltry amount” of cannabis revenue distributed to local governments.

- SB 6271 - “Modifying the cannabis excise tax to consider THC concentration.”

- Legislative staff published preliminary committee schedules for the third week of the 2024 regular session which indicated Senators planned to begin hearing cannabis-related bills as Representatives considered amending and recommending legislation out of committee.

- Monday January 22nd

- 10:30am: WA Senate LC - Committee Meeting [ Event Details ]

- 1:30pm: WA House RSG - Committee Meeting [ Event Details ]

- 1:30pm: WA Senate AWNP - Committee Meeting [ Event Details ]

- Public Hearing

- SB 6209 - “Concerning hemp consumable products.”

- Public Hearing

- Tuesday January 23rd

- 4pm: WA House RSG - Committee Meeting [ Event Details ]

- Thursday January 25th

- 8am: WA House RSG - Committee Meeting [ Event Details ]

- 1:30pm: WA Senate AWNP - Committee Meeting [ Event Details ]

- Executive Session

- SB 6209 - “Concerning hemp consumable products.”

- Executive Session

- Monday January 22nd

- On Thursday morning, members of the Washington State House Regulated Substances and Gaming Committee (WA House RSG) would reconvene to hear three cannabis bills and potentially move one as they made their way through a packed agenda.

- 8am: WA House RSG - Committee Meeting [ Event Details ]

- Public Hearing

- Executive Session

- HB 1650 - “Requiring voter approval for local government prohibitions on cannabis businesses.”

- 8am: WA House RSG - Committee Meeting [ Event Details ]